Download our go-to resource for a mortgage that won't bust your budget!

As a Dave Ramsey fan, you understand the importance of financial stability and staying out of debt. At Churchill Mortgage, we’re here to help guide you toward the real American Dream, debt-free homeownership, so you can own your home free and clear!

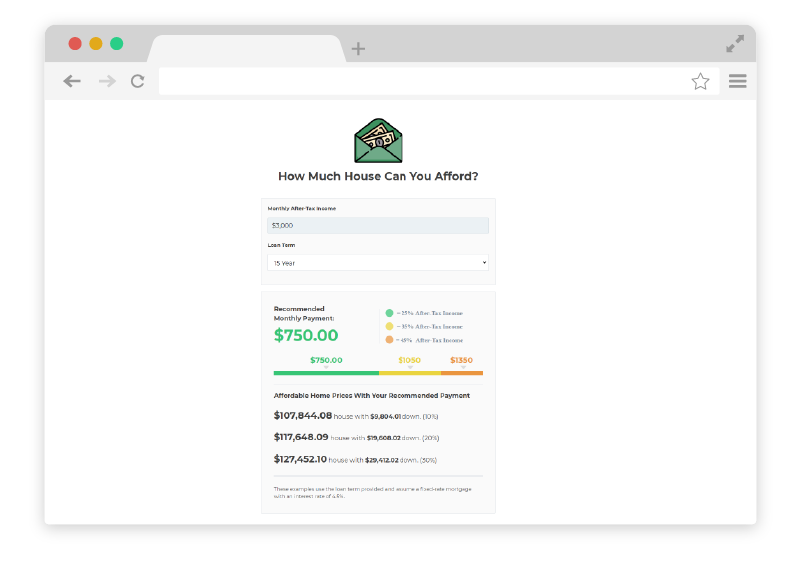

What Can I Afford?

When buying a home, you’ll likely have a lot of questions. The first thing you should do is find out how much house you can afford. We provide an easy-to-use calculator utilizing your monthly income with your projected loan term.

Dave recommends:

- Have a down payment of at least 10%

- Spend 25% or less of your monthly net pay

- Get a 15-year fixed-rate mortgage

Once you know your estimated home affordability, you can start building your personalized home buying team.

Popular Loan Options for Dave Ramsey Fans

Conventional Loans

This is the most common loan option and meets the needs of most people. Due to lack of government backing, they do require better credit to qualify. The overall cost is typically lower than most comparable government-backed loans.

Learn More About Conventional LoansNo Score Loans

If you have been working hard to pay off your debt and no longer have a credit score as a result of this, a no score loan might be a good option for you. You will go through a manual underwriting process to get this non-traditional mortgage.

Learn More About No Score LoansA Lower Interest Rate Could Save You Thousands!!

Because the interest rate on your home loan is directly tied to how much you pay on your overall mortgage, lower rates usually mean lower monthly payments.

Check out this example of monthly payments (principal and interest) on a 15-year fixed-rate loan of $250,000 at 5.5% and 4.0%.

Total Interest at 5.5% = $117,687

Total Interest at 4% = $82,860

With a 1.5% difference in interest rate, there is a $34,827 difference in interest paid! Imagine what you could do with that in your pocket!

* The scenarios listed above have an APR of 5.5% and 4% respectivly. Additional fees are not included in the examples above.

With so much of your hard-earned money on the line, it’s best to seek advice from a trusted home loan expert and have the confidence that you are in qualified hands.

Get the Smarter Mortgage

Owning a home and paying it off is one of the data points of an every day millionaire. At Churchill, our goal is to give you more power, clarity, and peace throughout the home buying process and ultimately help you get back to a debt-free lifestyle as soon as possible.

We make sure you get the smarter mortgage with the best value for your money, and provide insight on the top ways to pay off your mortgage as soon as possible.

Talk to a Dave Ramsey Mortgage Expert

Download the Churchill Mortgage App

The Churchill Mortgage app is easy to navigate, and keeps you up-to-date as key mortgage milestones are checked off.

It's easy to engage with a Dave Ramsey Mortgage Expert when you want, how you want, and from where you want!

Upload key documents securely anytime, anywhere

Stay connected to your home loan team

Monitor your progress, every step of the way

FAQs

Have a Mortgage Question?

Looking for answers to your questions about mortgages? We have got you covered. Learn more about real estate and loan terms, selling your home, and loan applications.

A: A lot of weight is put on a FICO® Score because it’s an easy way to do a quick risk assessment. If you don’t have a FICO® Score it can make qualifying for a mortgage a little more difficult, but not impossible. Many lenders do not offer no credit score loans.

A: Yes, Churchill Mortgage accommodates this type of loan on a regular basis with expertise. We work hard to make sure you are not penalized for non-traditional credit. Our Home Loan Specialists are professionally trained to help you get a smarter mortgage that can be paid-off quickly, so you can return to a debt-free lifestyle as soon as possible.

A: Typically, you must have four alternative credit tradelines with the most recent consecutive 12-month payment history from the creditor stating each were paid on time. Examples of alternative credit can be: cell phone bills, utility bills, insurance that’s paid monthly or quarterly (but not payroll deducted), school tuition, child care, or rent payments. If you are living rent free, a conventional loan without a 12-month rental payment history will require 12 months of assets to cover your principal and interest (P&I), taxes, property, flood, and mortgage insurance premiums. Click here to download our How to Buy a Home with Zero

A: We’ve found that a 15-year fixed rate loan with a 20 percent down payment gives you the best chance for approval. This type of loan eliminates the need for private mortgage insurance (PMI) and presents a lower risk to the loan servicer.

A: With no credit score available, an underwriter will go through your documentation to establish a history of payments for alternative credit. Don’t look for quick answers during this process. It can take about three times longer than a normal borrower file and sometimes additional documentation will be requested. Give your underwriter at least 60 days to look into the loan risks before issuing approval. Your Home Loan Specialist is always available to give a more detailed timeline for the underwriting process and to assist writing a contract closing date.

A: Don’t sign any sales contracts for a home purchase without protective contingencies to cover you in the contract. You’ll also want to make the sale contingent upon being fully approved, otherwise all earnest money can be returned to the buyer. Stay away from any 100 percent commitments until you know your loan has been “cleared to close” and there aren’t any other conditions needed.

A: Dave Ramsey recommends a 15-year, fixed-rate conventional loan. A conventional loan is not secured by a government agency, making it a little trickier to qualify if you don’t have a credit score. Requirements for a conventional loan with no credit score means you need at least 12 months of flawless payment history on eligible monthly bills, and you may also need to take a homeownership education class. If you do qualify for a conventional loan the benefits far outweigh the effort needed to qualify! We do have other no score loan options ranging including but not limited to FHA and VA.

A: First, fill out the form and connect with one of our Home Loan Specialists. Then determine how much you want your mortgage payment to be each month. We recommend no more than 25% of your take-home pay. Check out the How Much House Can I Afford? calculator to help you crunch the numbers! Next, you’ll want to review your Total Cost Analysis provided by your Home Loan Specialist.

A: Churchill Mortgage and Dave Ramsey are closely aligned through shared principles and core values. The two teams work together to help Americans buy homes the smart way and ultimately become debt-free. This is what we call the real American Dream. Churchill is the only lender that does that, and therefore, the only lender the Dave Ramsey talks about on his show.